The government of Saskatchewan expects to have a surplus of $1 billion in 2023–24, and they plan to use that money to pay down debt.

“This budget does not raise taxes or add any new taxes, which helps keep life in Saskatchewan affordable. When you add up taxes, utilities, and housing costs, our province is the most affordable place for a family of four to live in all of Canada “Finance Minister Donna Harpauer said.

She said that the government talked about giving adults in the province another round of “affordability checks,” but decided against it because they wanted to spend their money more wisely.

Hapauer said that Saskatchewan can’t depend on “volatile” revenue from natural resources every year. She said that her government doesn’t think this year’s big surplus is a sign of things to come.

“As a government, we have to be very careful not to add one-time income to our running costs from year to year.”

Last year, the government said that the next year would have a $463-million deficit and that it didn’t expect a surplus until 2026-27.

These predictions turned out to be much worse than what actually happened. By the end of the first quarter, the government thought that the 2022-23 year would end with a surplus of $1 billion.

Harpauer said that the government wants to use this year’s expected $1.017 billion surplus to pay down its operating debt.

“Because Saskatchewan’s economy is growing and its finances are strong, our government will pay off up to $1 billion in operating debt this fiscal year. This will lower interest costs and allow the savings to be put toward services, programs, and capital that are needed.”

The government said that getting rid of debt and borrowing less has saved $117 million in interest each year, including last year.

By the end of March 2024, the gross debt is expected to reach $30,9 billion.

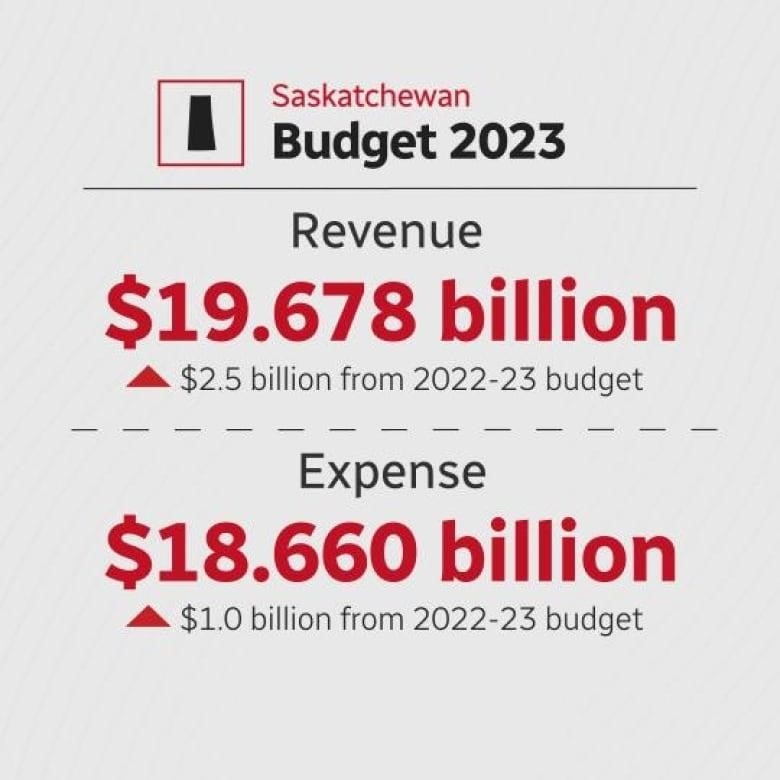

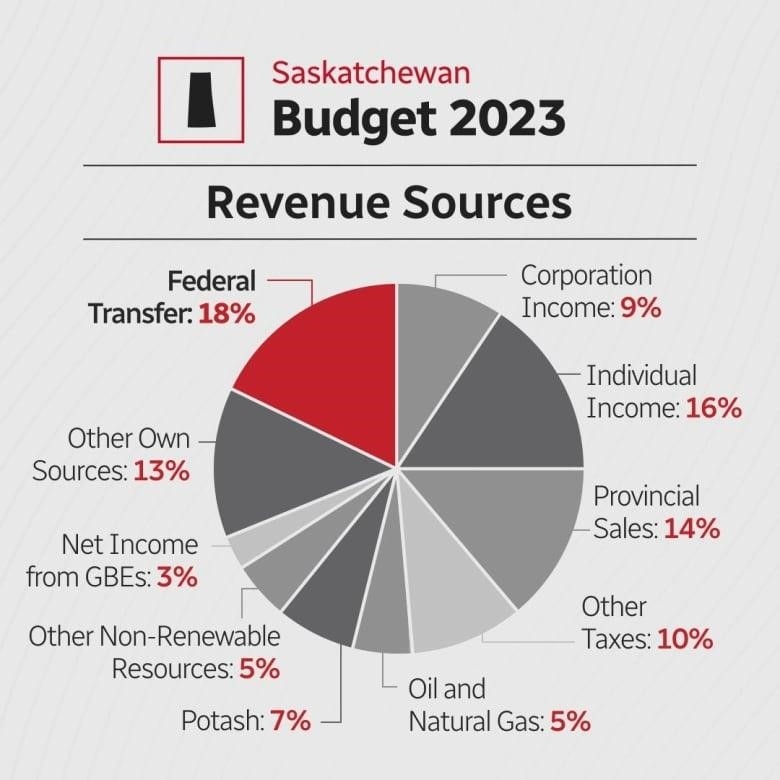

The budget for the next fiscal year is set at $19.7 billion, which is $2.5 billion or 14.7% more than the budget for 2022-23. The top three sources of income are:

- Taxes: $9.6 billion.

- Federal transfers: $3.6 billion.

- $3.3 billion for resources that don’t grow back.

Harpauer said that the government didn’t decide to raise or add to taxes. Last year, the government put a PST on entertainment events and gym memberships. A few months later, the government got rid of the gym membership tax.

Since the province’s finances are in the black, Harpauer said the government decided not to lower or get rid of the PST on some items, which is something the Opposition has been calling for.

Harpauer said that the “difficult decision” to raise and expand the PST in the past was made to make the government less dependent on revenue from natural resources.

“I don’t think we are in a position to try to take some of that back. I have a lot of hope that we will get there, though, because the private sector is putting a lot of money into growth in our province.”

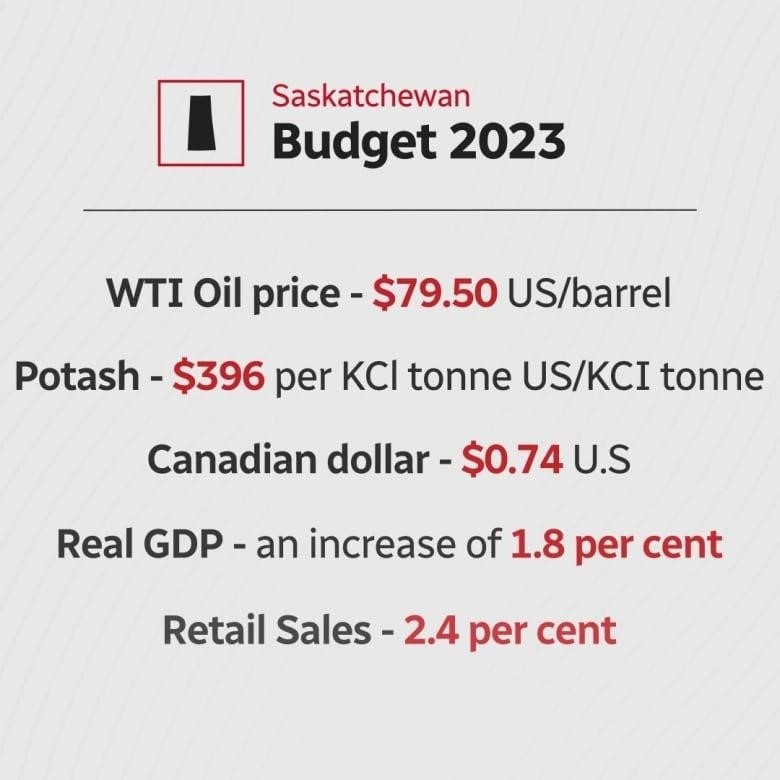

The government based Wednesday’s budget on the following predictions:

- WTI Oil price— $79.50 US/barrel.

- Potash costs $396 per US/KCI tonne of KCl.

- Canadian dollar — $0.74 US.

- Real GDP — up 1.8 per cent.

- Retail Sales —up 2.4 per cent.

Spending is also on the rise, but not as fast as income. The government said it will spend $18.7 billion in 2023–24, which is 5.9% more than what it planned to spend in 2022–23.

Healt

The Ministry of Health is expected to spend $6.9 billion this year, which is an increase of $431 million, or 6.7%. The Saskatchewan Health Authority is getting an extra $191,4 million for running its business.

Harpauer said that the money is “strengthening the health-care system and taking important steps to attract, train, and keep doctors, nurses, and other key health-care workers in a growing province.”

The government’s Health and Human Resources Action Plan will get $98.8 million from the budget. Three government ministries pay for the plan.

More than $55 million will go toward hiring 250 full-time workers and adding to the number of part-time jobs in rural and remote parts of the province.

In the portfolio for advanced education, the government will spend $25,2 million to add 550 seats to 18 health training programs.

The budget includes an extra $42.5 million for surgeries. By the end of March 2024, the goal is to cut the surgical wait list to “pre-COVID levels.”

The budget for mental health and addictions is now $518 million, which is 7.5% of the whole health budget.

Educatio

The 27 school divisions in Saskatchewan will get an extra $49.4 million, or 2.5% more than they did last year. The government will also spend $7 million to keep more than 200 people who help with education. Last year, the EAs were hired with $7 million from the ministry.

The Saskatchewan Distance Learning Corporation is being set up at a cost of $23 million by the province. It will have classes from kindergarten to grade 12 that can be taken online.

The federal government is giving $72.1 million to help pay for child care and early learning, so Saskatchewan can offer child care for $10 per day. This is the biggest new expense in the education budget.

Social Service

This year, the budget for the Ministry of Social Services is $1.43 billion, which is an increase of $46.7 million, or 3.4%, from last year’s budget.

Both the Adult Basic Benefit and the Shelter Benefit for people who get Saskatchewan Income Support (SIS) will go up by $30 per month. People on SIS who use other ways to heat their homes will also see a $30 increase.

Assured Income for Disability (SAID) clients in Saskatchewan will get $30 a month to help them live. People who live in personal care homes and are under 65 years old will get up to $684 more per month.

The monthly amount of the Seniors’ Income Benefit will go up by $30, to $360. Up to $400 more will be added to the Personal Care Home Benefit each month.

The ministry is spending an extra $6,7 million to help people with intellectual disabilities get support services.

Spending is going to the wrong places, says the opposition

The NDP Opposition said that the budget for 2023-24 doesn’t do enough to help with the rising cost of living.

“This budget doesn’t help parents who are struggling to make ends meet. When making a budget, you have to make choices. Party ignores the problems that keep regular people awake at night, “Carla Beck, leader of the opposition, said.

The opposition called the increase in income support “a measly dollar-a-day bump.”

Beck said that the budget doesn’t do anything about problems in health care and in the province’s schools.

“I really thought that this budget would include some kind of investment in our K–12 system. We don’t think so. We don’t see an investment that even meets inflation.”

Trent Wotherspoon, a critic of the government’s finances, said that the government has a lot of money but is spending it in the wrong places.

“This budget doesn’t help families who are having a hard time paying their bills at the end of the month in any new way.”

Capital Spendin

This year, the government has set aside $3.7 billion for big projects:

Projects include:

- The Prince Albert Victoria Hospital will get $98.6 million.

- The Weyburn General Hospital needs $38 million.

- $20 million for a long-term care home in La Ronge.

- $776 million was spent on roads and highways in the provinces.

- $152.3 million for capital for schools (five new schools, planning and construction of 15 new schools, and the renovation of five existing schools).

Future projection

The government thinks there will be surpluses for three years in a row:

- 2024/25: $208 million.

- 2025/26: $134 million.

- 2026/27: $101 million.